Don’t Get Burned By The IRS – Tax Tips for Restaurant Owners

Modern Restaurant Management

AUGUST 27, 2024

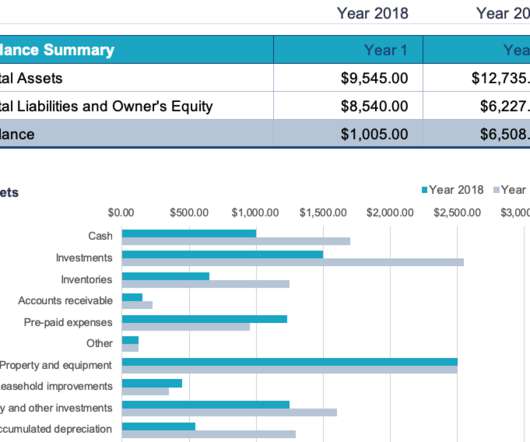

By the time you manage inventory, staffing, customer demand and narrow profit margins, the last thing you want to think about is the IRS. Restaurants, like other cash-intensive businesses, are a frequently targeted for audits by the IRS. By keeping accurate and complete records, you can reduce the length and pain of an audit.

Let's personalize your content