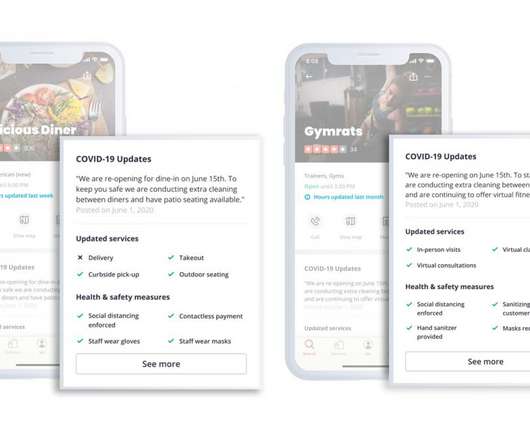

Four Ways to Streamline Reopening Procedures for Restaurants

Modern Restaurant Management

JUNE 8, 2020

” Restaurant managers who develop clearly-documented policies, operational checklists, and clear communication systems can simplify the process for everyone. All of these policies should be clearly documented, and all employees should be required to read and sign-off on them. Employee well-being. Customer well-being.

Let's personalize your content