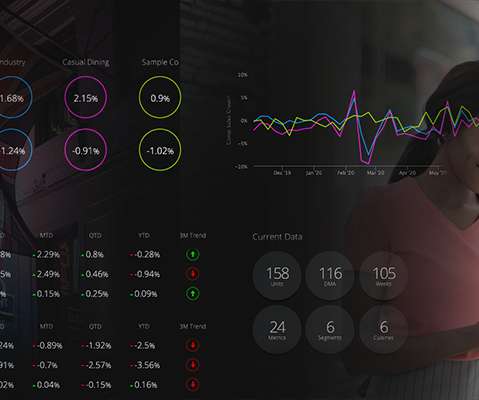

State of the Restaurant Industry Q4 2024: Key Insights and Trends

Black Box Intelligence

OCTOBER 29, 2024

Here is what we are seeing: Quick service restaurants (QSR) They have shown resilience with relatively stable traffic and sales This is artially attributed to price-conscious consumers opting for lower-cost dining options amid inflation. Casual Dining Both traffic and sales underperforming compared to QSR and fast casual.

Let's personalize your content